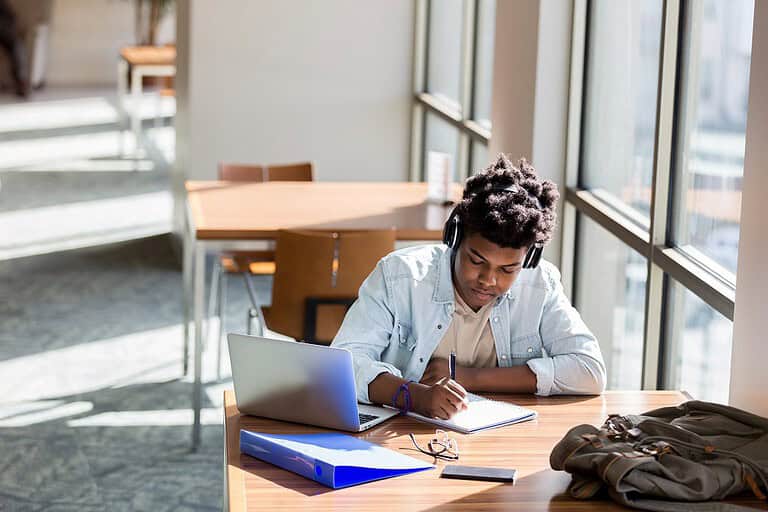

Attainable® Savings Plan

Individuals with disabilities can save in a tax-advantaged account without affecting federal benefits.

What is the Attainable® Savings Plan?

Attainable® is the official ABLE savings plan of Massachusetts, sponsored by MEFA and managed by Fidelity Investments.

Multiple Options

Various investment options professionally managed by Fidelity Investments

Range of Expenses

Funds may be used for a wide array of qualified disability expenses

Protects Federal Benefits

May be used without affecting other disability-related benefits, such as SSI (up to accounts of $100,000)

Tax-Deferred Growth

Contributions grow tax free, with tax-free withdrawals on qualified expenses

How Attainable® Works

Learn the basics of opening and using an Attainable® account.

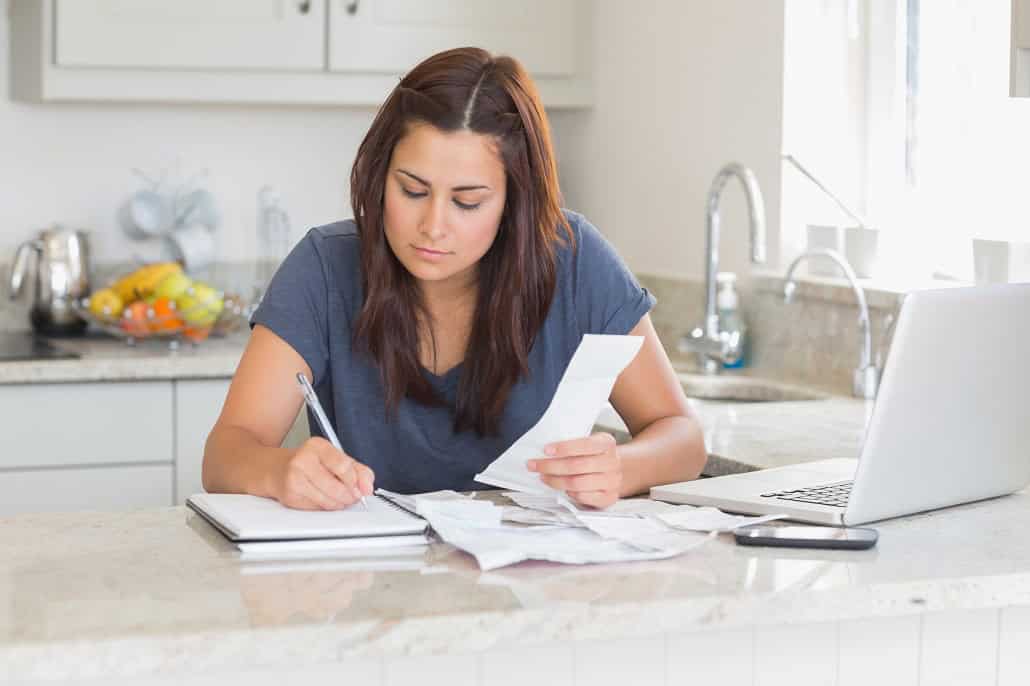

Account Limits

There is no minimum needed to open an Attainable® account. Funds may be added at any time, up to an annual limit of $19,000. Attainable® beneficiaries in the continental U.S. who work and earn income may contribute $15,560 over the annual limit of $19,000 into their ABLE account, due to the ABLE to Work legislation (this amount is higher in Alaska and Hawaii). An account balance can grow without limit, but no additional contributions can be made that cause the balance to exceed $500,000.

Account Spending

Attainable® funds may be spent on any qualified disability expense.

Account Earnings

Earnings in an Attainable® account are federally tax-exempt and qualified distributions are not federally taxed.

Eligible individuals are those entitled to benefits based on blindness or disability under title II or XVI of the Social Security Act, and such blindness or disability must have occurred before the date on which the individual turned age 26. The Attainable® Savings Plan does not require submission of documentation regarding the disability, but the IRS or Social Security Administration reserves the right to request this documentation and thus eligible individuals must retain proof in their personal records. Individuals saving in an Attainable® account will be required to certify and attest on the Attainable® account application that they meet and comply with the eligibility requirements as set forth under IRC Section 529A, including the annual re-certification requirements. Each beneficiary may have only one Attainable® Savings Plan account, and the account owner must be the beneficiary. If the account owner is a minor child or incapable of managing the account, a person with signature authority (PSA) can open and manage the account. The PSA has full control over the account and must be the beneficiary’s parent, legal guardian, or agent acting under the Power of Attorney (POA).

It’s easy to open an Attainable® Savings Plan account. To get started, visit the Fidelity Investments website. Open an Account

The ABLE National Resource Center is managed by the National Disability Institute and is a resource for ABLE education. The site offers frequent webinars, overall basic information on ABLE accounts, and a state program comparison tool.

SSA Program Operations Manual System (POMS) for ABLE

The Social Security Administration has substantial information on ABLE accounts and how they relate to Social Security.

Project Impact through the Massachusetts Rehabilitation Commission offers benefits counseling for those employed or looking for a job who receive SSI or SSDI. This service is offered in Essex, Barnstable, Bristol, Dukes, Nantucket, Norfolk, Plymouth and Suffolk counties. Project Impact has three designated student benefits counselors who work throughout the entire state with students up to age twenty-two.

Work Without Limits Benefits Counseling

If you live in Berkshire, Franklin, Hampden, Hampshire, Middlesex or Worcester Counties, you may contact the UMass Medical School’s Work Without Limits Benefits Counseling to receive help understanding how your wages may affect your benefits.

The Arc is a nationwide disability organization that serves those with intellectual and developmental disabilities. There are local chapters located throughout the Commonwealth.

The Arc of Massachusetts raises awareness for programs and legislation in Massachusetts for individuals with intellectual and developmental disabilities.

Massachusetts Down Syndrome Congress (MDSC)

The MA Down Syndrome Congress offers information, networking opportunities, and events for the Down Syndrome community.

National Alliance on Mental Illness (NAMI) Massachusetts

The Massachusetts chapter of NAMI offers education and support groups for both individuals and families with mental health conditions.

Massachusetts Office on Disability

The MA Office on Disability advocates to advance the legal rights, accommodations, and accessibility for those with disabilities across all aspects of life.

IRS Publication 907 is published annually by the IRS and is specifically for individuals with disabilities filing tax returns.

Disclosures

Get Updates on Attainable®

Sign up to receive email updates about the Attainable® Savings Plan.

My daughter receives SSI and works part time as well. We are so pleased to finally have found a way that she can have a savings account and still maintain the benefits she receives. We are hopeful that through this program she will become more proficient in saving and managing her finances. I feel relieved that she can now have an account to save some of her hard-earned wages for expenses related to her disability.

As guardian for a disabled family member, having the ability to purchase mobility equipment has improved their ability to participate in normal living.

Every family with a disabled member should hear about these accounts and get help setting them up. It helps give me peace of mind to know my son will have access to this when I am gone.

I am so happy I am ABLE to save money for my daughter and her needs without being penalized for having a savings account. Bravo to the mind of who created this program.

I have been ABLE to contribute to my disabled son’s account so that he will have his own funds available to help him when I am no longer here to help him financially. This has given me a substantial peace of mind that he will have an additional source of funds to draw from in the future. I suggest that every family with a disabled member contribute as much as possible to help assure their member’s financial future.

I have not needed to withdraw any funds from my daughter’s account, but we rest assured that when/if the need arises, we have a nicely growing Attainable account to fall back on.