Parents can benefit their children with disabilities by setting up an Attainable® Savings Plan account at the earliest opportunity and giving them the longest time possible to grow. The Stephen Beck, Jr. Achieving a Better Life Experience (ABLE) Act amended the federal tax code in 2014 to add Section 529A. This legislation established ABLE accounts, tax-exempt accounts for eligible individuals with disabilities to be used for qualified disability expenses while allowing them to keep eligibility for federal public benefits. The Massachusetts ABLE plan is called the Attainable® Savings Plan, offered by MEFA and managed by Fidelity Investments.

One of the reasons the ABLE Act was passed was due to the understanding that, at times, there are additional costs for everyday activities due to barriers related to disabilities. These can include certain types of rooms in a hotel on a trip, a vehicle that can accommodate a mobility aid or personal aid, assistive technology, medication copays, or household construction.

Transition planning for adulthood begins in the school system starting at age 14 per the IDEA (Individuals with Disabilities Education Act). Sometimes this planning prompts families to start saving in an Attainable® account, but really, families would benefit from starting to save much earlier. As an investment account, the Attainable® Savings Plan provides more value the longer it has been established. The difference between an account established at birth versus one established at age 14 is significant.

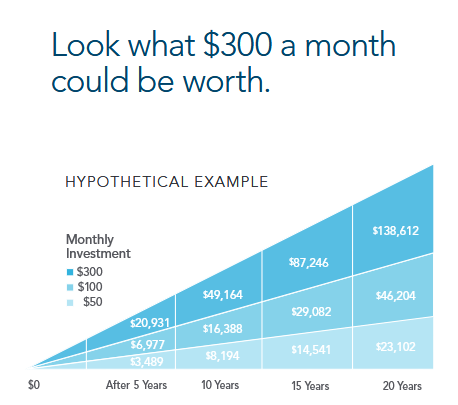

This chart can help visualize potential growth in an Attainable® account*.

- If a family puts $100 per month into a jar at home for 20 years, they will have $24,000.

- If that same money was put into an Attainable® account, the family could hypothetically have over $46,000 instead.

Attainable® Savings Plan funds can be used for housing, transportation, medical expenses, college or vocational trainings, as well as many other necessities. The accounts create an excellent nest egg for an individual transitioning into adult services.

Funds in an Attainable® Savings Plan account do not affect eligibility for SSI or SSDI (for accounts up to $100,000) or for Medicaid. Contributions can be made by anyone, including friends and family.

If you believe that you, or someone you know, could benefit from one of these specialized accounts, please visit mefa.org/attainable® for more information.

*This hypothetical example illustrates the potential value of different regular monthly investments for different periods of time and assumes an average annual return of 6%. Contributions to an Attainable® account must be made with after-tax dollars. This does not reflect an actual investment and does not reflect any taxes, fees, expenses, or inflation. If it did, results would be lower. Returns will vary, and different investments may perform better or worse than this example. Periodic investment plans do not ensure a profit and do not protect against loss in a declining market. Past performance is no guarantee of future results. Source: https://www.fidelity.com/bin-public/060_www_fidelity_com/documents/attainable/fidelity-attainable_able-save-dream.pdf