When comparing private college loans, many families are drawn to lenders advertising the lowest interest rate. And that makes sense. A low interest rate generally means more affordable monthly payments and a lower total cost. A college loan interest rate that starts somewhere near 3% sounds like a win. But this only tells part of the story.

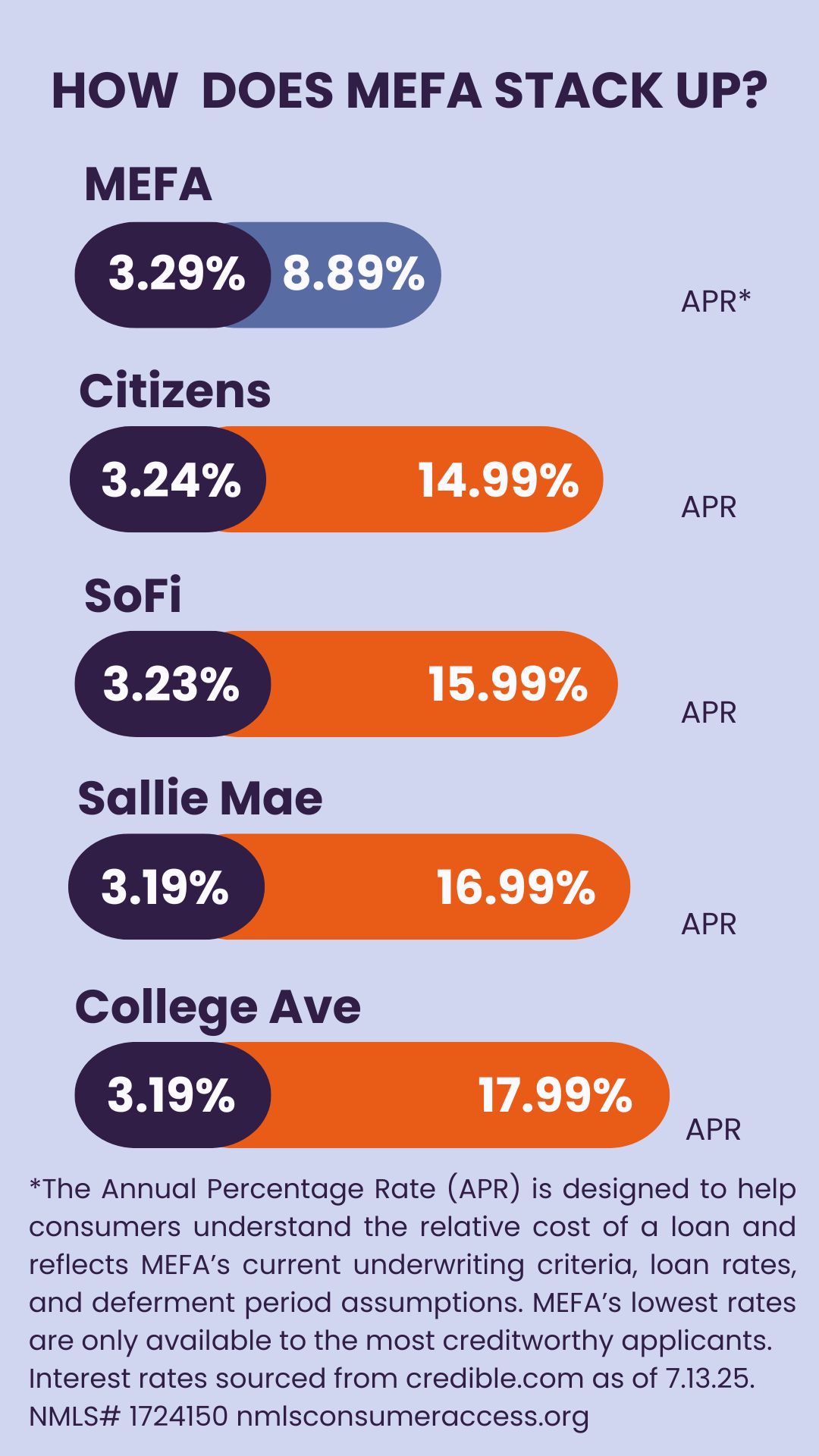

Take a close look at the graphic below:

This graphic highlights actual lenders that offer college loans, as well as the range of interest rates associated with their loans, as shared on credible.com as of 7/13/25. Each lender listed promotes a low starting Annual Percentage Rate (APR). But as the graphic clearly shows, the upper end of the rate range varies significantly. And that’s what families can often overlook.

While MEFA’s interest rates range from 3.29% to 8.89% APR*, other lenders go much higher:

- Citizens Bank: Up to 14.99% APR

- SoFi: Up to 15.99% APR

- Sallie Mae: Up to 16.99% APR

- College Ave: Up to 17.99% APR

Why the Range Matters

The range of APRs represents what different borrowers may actually qualify for based on their credit profile, income, debt, and whether or not they apply with a qualified co-borrower. Only the most creditworthy applicants receive the lowest rates.

If you don’t fall into that top tier—and most families don’t—you may be approved for a rate much closer to the upper end of the range. And over the life of a loan, the difference between an 8% and a 17% APR could mean thousands of dollars in extra interest payments.

What Sets MEFA Apart

MEFA stands out in this comparison for offering both a competitive starting interest rate and a notably lower maximum interest rate. While MEFA’s lowest APR is similar to other lenders’, its top interest rate of 8.89% is far below the 15–18% range of its competitors. That gives families more assurance that they won’t be surprised by a significantly higher rate after applying.

Smart Borrowing Tips

When comparing your options for a private college loan, consider the full picture before you make your final decision.

- Review the full APR range, not just the lowest rate.

- Understand the criteria lenders use to determine your rate.

- Always compare fixed vs. variable rates and repayment terms.

Don’t limit your search for college loans to comparison sites, which may only feature lenders that have paid for representation. Check also with the college financial aid office, as well as friends and neighbors. Compare the key details of several lenders at once before deciding on the one you’ll use.

Final Thought

The lowest rate may catch your eye—but the highest possible rate tells you more about what you might really pay. Choosing a lender like MEFA that offers a narrower range of interest rates can help ensure that borrowing for college doesn’t lead to unnecessary interest costs, increasing your long-term debt. Make sure you’re considering all your options before you sign on the dotted line.

If you’re interested in borrowing a MEFA Loan, there’s an easy, online process to apply. Follow along step-by-step here or simply click below to start the application process.

*The Annual Percentage Rate (APR) is designed to help consumers understand the relative cost of a loan and reflects MEFA’s current underwriting criteria, loan rates, and deferment period assumptions. MEFA’s lowest rates are only available to the most creditworthy applicants.

NMLS# 1724150 nmlsconsumeraccess.org