Boston [7/17/25] – For many families, a college loan bridges the gap after financial aid between the family’s ability to pay and the full cost of college. With so many options available, it’s easy to get distracted by a low-advertised interest rate, small incentive, or a catchy tagline. That’s why MEFA advises families to look at the whole picture carefully to understand the true cost of borrowing.

“It’s critical to weigh not only the interest rates, but all components of any loan, to understand how much the loan will cost you in the long run,” said Thomas Graf, Executive Director of MEFA, Massachusetts’ hometown lender. Created in 1982 at the request of Massachusetts colleges and universities, MEFA serves a public mission to help families with higher education access and affordability by offering expert guidance, tools, and resources to help families plan and pay for college.

How can families make the best borrowing decisions for their future?

Start by doing your homework—and don’t get distracted by a low-advertised interest rate. While it’s tempting, there’s much more to consider when deciding on a college loan. Many lenders offer a range of fixed and variable interest rates, as well as different repayment options, and some may even have fees associated with the loan. A thoughtful comparison could make a significant difference in the total cost of borrowing.

Before considering private loans, families should complete the FAFSA® to secure the maximum amount available in financial aid, including Federal Direct Student Loans. Federal Direct Student Loans offer favorable terms to the student, such as a fixed interest rate, flexible repayment options, and the ability to consolidate.

Once a student has secured the maximum available financial aid, MEFA’s experts offer the following tips for families looking at private loan options for the 2025-26 school year:

1. Understand How Interest Rates Work and What Affects Them

Private education loan lenders offer both fixed and variable interest rates, however the lowest rates are typically reserved for borrowers with excellent credit histories. The type of repayment plan and loan term you choose also impacts the rate. For example, opting for a repayment plan that defers payments until after graduation typically leads to a higher cost of education.

A loan’s interest rate has a direct impact on its overall cost, so it’s important to understand how choices now will affect repayment. MEFA’s Undergraduate Loan Payment Calculator shows how different repayment options impact the total cost of a MEFA Loan.

2. Carefully Compare Private Loan Offers

All private lenders are required to provide an Application and Solicitation Disclosure that outlines the cost of the loan, including fees. Take time to review this document for each lender to understand the full cost of any loan you’re considering. MEFA’s Comparing College Loan Options webinar offers the basics to help borrowers read and understand these disclosures.

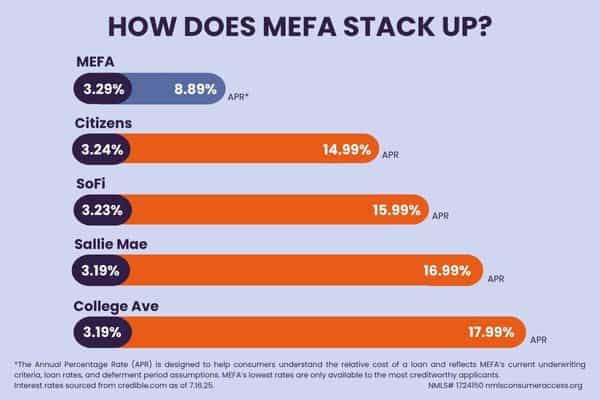

Currently, MEFA’s Undergraduate Application and Solicitation Disclosure shows fixed interest rates between 3.29% and 8.89% APR*—with no application fees, no origination fees, and no late charges. Compare these costs to the Federal PLUS Loan, which carries a fixed interest rate of 8.94% plus a 4.228% fee. And MEFA’s top rate is much lower than the top rates of other private lender loan options. Additionally, MEFA’s undergraduate loans require both the student and a parent or other creditworthy co-borrower to be on the loan. This shared responsibility helps instill smart borrowing habits.

The disclosure includes scenarios for each of MEFA’s repayment options, including immediate repayment, interest-only repayment while enrolled, and deferred repayment.

3. Know the Ins and Outs of the PLUS Loan

The Parent PLUS Loan is a federal loan option available exclusively to parents to help pay for education expenses not covered by other financial aid. Offered by the U.S. Department of Education with a 2025-26 interest rate of 8.94%, plus a 4.228% origination fee, the PLUS Loan requires the submission of the FAFSA and can be a costly borrowing option. For some families, this combination of high costs and lack of shared responsibility may make the Parent PLUS Loan a less attractive option.

4. Get Expert Guidance Every Step of the Way

MEFA’s team of college planning experts is available to help families navigate the process of finding and applying for a college loan. Whether providing help with comparing loan options, understanding terms and conditions, or exploring repayment strategies, MEFA is equipped to listen and offer expert guidance. Reach out to MEFA at (800) 449-6332 or via email at [email protected].

For additional resources, visit mefa.org, for free live and recorded webinars, helpful videos, and expert articles covering a full range of topics, including Tips for Private Student Loans.

*The Annual Percentage Rate (APR) is designed to help consumers understand the relative cost of a loan and reflects MEFA’s current underwriting criteria, loan rates, and deferment period assumptions. MEFA’s lowest rates are only available to the most creditworthy applicants. Before borrowing a private loan, MEFA encourages students to exhaust financial aid alternatives including, grants, scholarships, and federal student loans. NMLS # 1724150

###

About MEFA

MEFA is a state authority, not reliant on state or federal appropriations, established under Massachusetts General Laws, Chapter 15C. MEFA’s mission, since its founding in 1982, has been to help Massachusetts students and families access and afford higher education and reach financial goals through education programs, tax-advantaged savings plans, competitive loans, and expert guidance. All MEFA’s work aligns with the ever-present goal to support the independence, growth, and success of Massachusetts students and families. Visit mefa.org to learn more.

Media Contact:

Lisa Rooney

(617) 224-4838

[email protected]