Borrowing Wisely Means Having a Plan

Graduating high school seniors, you sure have a lot on your plate right now, don't you? Planning for life this fall-whatever you have planned-is likely keeping you busy. If you're continuing your education at college, you've likely already had the "How are we going to pay for this?" conversation with your family.

If you're in the position, like many students, of needing to borrow a loan, it's important to add one more thing to your to-do list. You should try to imagine your life after college, and how student loan repayment might affect that lifestyle. Here are some things to take into consideration:

- What do you expect to make in your first job? Preschool teachers make an average of $43,750 per year, a human resource specialist makes approximately $79,950 per year, a web developer makes approximately $92,570 per year, and a chemical engineer makes around $113,190 per year[1]. You can research other average salaries on the Bureau of Labor Statistics website here.

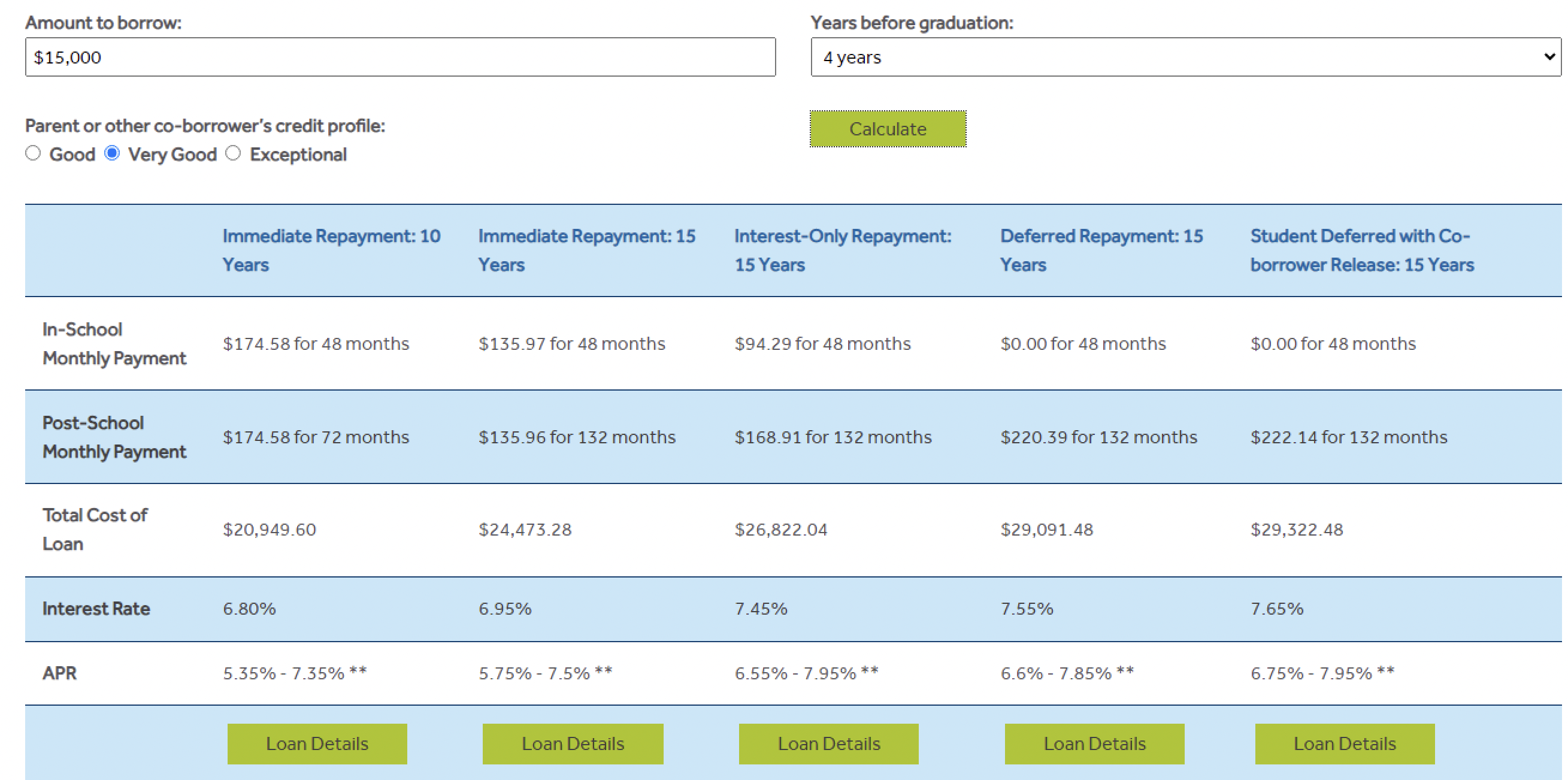

- What will your loan payment look like when you graduate? If you plan to borrow the maximum amount of your Federal Direct Student Loan every year (the loan likely featured on your financial aid offer), you can plan for a loan payment of about $300 per month. But if you need to borrow a private loan on top of that federal loan, you should anticipate an even larger monthly payment. You can use MEFA's Student Loan Payment Calculator to estimate your future loan payment if you borrow a MEFA Loan. Remember, if you plan to borrow for more than one year, you'll need to do the calculation more than once, and then add up the total of your anticipated monthly payments.

- Estimate your other future expenses. Will you rent an apartment? The median rent for a one-bedroom apartment in Boston is $3,193[2], not including utilities such as heat, hot water, electricity, cable and internet. You can see a rough breakdown of living expenses in Boston here. Will you need a car, or take a train? An average car payment for a used car is $516[3], while a monthly subway/bus pass will cost approximately $90 each month[4]. You'll also need to eat, of course, and pay for health insurance.

Account for what your monthly expenses might be by doing some internet searching to find out the average cost of renting in the city you plan to live, and estimates for average costs of living to help you build this calculation.

With these estimated calculations, you can start to build the picture of what your financial situation might look like. Compare your anticipated income each month (remember to account for paying taxes!) with your projected expenses. This analysis can help you determine if you really can afford to borrow as much as you anticipate for college. Will you need to make some sacrifices in order to make those loan payments, such as moving back home? Will you be able to afford to build a savings account, save for retirement, and have an adequate travel and entertainment budget?

It can be really tough to imagine what it will be like when you graduate from college. But believe us, if you bury your head in the sand now, it will be even tougher to swallow the numbers on your student loan bills when you enter repayment. Think through your future budget now, and make smart decisions on how much to borrow over the next four years. If you have any questions about your student loan options, or how to plan for your future repayment, please reach out to us at collegeplanning@mefa.org or (800) 449-6332.

[1] May 2022 State Occupational Employment and Wage Estimates for Massachusetts

[2] The Cost of Living in Boston

[3] What You Can (and Can't) Learn From the Average Car Payment

[4] MBTA Fares Overview